TAX317: TAXATION 2 Assignment, UiTM, Malaysia Business entity located in Malaysia that manufactures taxable goods not exempted under the Sales Tax Act 2018

| University | Universiti Teknologi MARA (UiTM) |

| Subject | TAX317: TAXATION 2 |

- You are required to create a business entity located in Malaysia that manufactures taxable goods not exempted under the Sales Tax Act 2018, Sales Tax Order 2018, and any other recent applicable exemption orders of the Minister of Finance. Your business entity should have the followings profile:

i. Name of your business entity and the type of business organization.

ii. Date of business registration and commencement.

iii. Registered address and contact details (telephone, email) of your business.

iv. Place of manufacturing address.

v. Name of owners/directors.

vi. List at least TWO (2) taxable goods manufactured by your business.

- Assumes that the following information are pertaining to your business:

a. The business carries out manufacturing activities to produce taxable goods.

b. Financial year ends on 30 June each year.

c. Sales transactions are performed on both cash and credit basis.

d. Goods manufactured and sold are under the category of taxable goods.

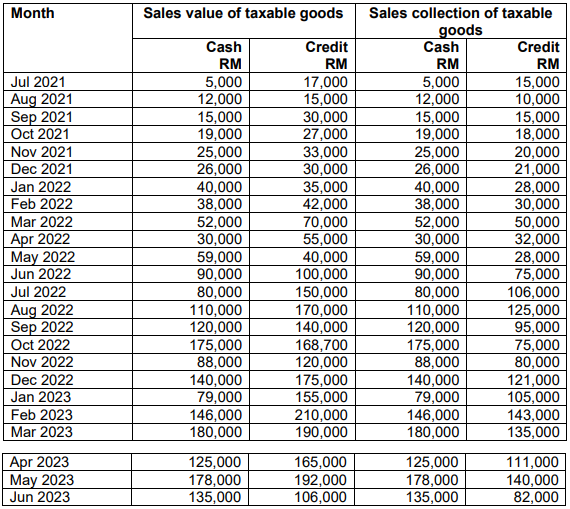

e. Below are the Monthly Sales Report for the financial year end 2022 and the Projected Sales Report for the financial year end 2023.

i. Based on the above information, explain when your business is required to apply for the sales tax registration using the historical method (support your answer with relevant computation and by filing the SST-01 form).

ii. Explain when will your business charge sales tax to customers.

iii. For each of the following items made by your business, calculate the amount due to RMCD (if any) according to the Sales Tax Act 2018. Justify your answer if the transaction is not subjected to sales tax.

a. For cash sales made in the month of January 2022.

b. For credit sales made in the month of May 2022.

c. For RM75,000 sales made in June 2022 which were sold to customers in designated areas.

d. For RM25,000 of sales made in June 2022 has been donated to charity organizations in Malaysia. The cost of the goods donated amounted to RM18,000.

iv. Based on information in (iii), explain the submission requirement of SST-02 and payment of sales tax.

v. Based on information in (iii) and (iv), describe the consequences according to

Sales Tax Act 2018 if your business remitted the amount of sales tax to RMCD on 15 September 2022

vi. Assuming today is 31 March 2023. The following is information about one of your customers.

Get Help By Expert

Assignmenthelper.my is your one-stop shop for thesis writing services! We pride ourselves in providing stress-free and affordable thesis writing assistance for students of all backgrounds and academic levels. With the help of our professional assignment writers, you can count on a personalized thesis paper that meets all of your research requirements and is supported by reliable evidence in a timely manner. Additionally, we extend our expertise to CHE433 Thermodynamics Assignment and other subjects. Trust AssignmentHelper.my for comprehensive thesis writing services and reliable solutions to all your academic challenges.

Recent Solved Questions

- Unit 1 Assignment – Financial For Business V01.09.2024

- MPU3412 : Community Service Assignment, OUM, Malaysia Writing a Reflective Journal about the Community Work .

- LLB202B: Explain the legal framework governing the process of public auctions in Malaysia: FACULTY OF LAW & GOVERNMENT Assignment, HU, Malaysia

- Unit 3 – International Marketing Management, Assignment, Malaysia

- Centre For English Language & General Studies Assignment 1 Group Assignment

- Information Technology Assignment, APU, Malaysia List and explain the IT hardware requirements needed in each branch to allow communication between each office

- Business Assignment, TU, Malaysia Select TWO foreign cultures, one from the East and one from the West of the world. Compare and evaluate the differences between

- AICT006-4-1-AFM Advanced Forensics Methods Assignment, APU, Malaysia

- MPU3193: Philosophy and Current Issues Assignment, WOU, Malaysia After 64 years of being an independent country, do you think that Malaysia is free from the influence of Western colonization

- BBMP1103: Specify a set of number of : positive odd integer which less than 10: Mathematics For Management Assignment, OUM, Malaysia