D2FIN100: Introduction to Finance Assignment, HU, Malaysia Suppose the stock of Host Hotels & Resorts is currently trading for $20 per share. If Host does a 3:2 stock split

| University | HELP University (HU) |

| Subject | D2FIN100: Introduction to Finance |

Question 1

- Suppose the stock of Host Hotels & Resorts is currently trading for $20 per share.

a. If Host does a 3:2 stock split, what will its new share price be?

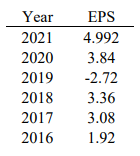

b. If Host does a 1:3 reverse split, what will its new share price be? - Given the earnings per share over the period 2016 – 2021 shown in the following table, determine the annual dividend per share under each of the policies set forth in parts a and b.

a) Pay a $1.60 dividend per share and increase to $1.90 per share whenever earnings per share rise above $2.9 per share for two consecutive years. After that, the new earnings plateau is to further increase the dividend per share to $2.3 whenever earnings per share rise above $4.2 for two consecutive years.

b) Pay $1.60 per share except when earnings exceed $3.20 per share, in which case pay an extra dividend of 60% of earnings above $3.20 per share.

- The dividend payout ratio equals dividends paid divided by earnings. How would you expect this ratio to behave during a recession? What about during an economic boom?

Question 2

- Canadian-based mining company Canada Gold (CG) suspended its dividend in March 2016 as a result of declining gold prices and delays in obtaining permits for its mines in Greece. Suppose you expect CG to resume paying annual dividends in two years’ time, with a dividend of $2.25 per share, growing by 5% per year. If CG’s equity cost of capital is 10%, what is the value of a share of CG today?

- Procter and Gamble (PG) Company has just paid an annual dividend of $2.50. Analysts are predicting dividends to grow by 8% per year over the next three years. After then, PG’s earnings are expected to grow 3% per year, and its dividend payout rate will remain constant. If PG’s equity cost of capital is 8.5% per year, what price does the dividend discount model predict PG stock should sell for today?

Question 3

- What is the cost of capital? What role does the cost of capital play in the firm’s long-term investment decisions? How does it relate to the firm’s ability to maximize shareholder wealth?

- Do the net present value (NPV) and internal rate of return (IRR) always agree with respect to accepting–reject decisions? With respect to ranking decisions? Explain.

- Robin Millar has the opportunity to invest in project A which costs $18,000 today and promises to pay annual end-of-year payments of $4,400, $5,000, $5,000, $4,000, and $3,600 over the next 5 years. Determine the payback period for project A.

Question 4

International Business Machine is considering relaxing its credit standards to increase its currently sagging sales. As a result of the proposed relaxation, sales are expected to increase by 10% from 10,000 to 11,000 units during the coming year, the average collection period is expected to increase from 45 to 60 days, and bad debts are expected to increase from 1% to 3% of sales. The sale price per unit is $40, and the variable cost per unit is $31. The firm’s required return on equal-risk investments is 25%. Evaluate the proposed relaxation, and make a recommendation to the firm.

Get Help By Expert

Assignmenthelper.my is the perfect choice for any student who needs essay writing help. Professional essay writers with years of experience in academia provide the highest quality of custom essay writing services. Their round-the-clock customer service and fast turn-around time guarantee that all essay orders are fulfilled according to the deadline, freeing students from essay-related stress. Plus, if you're working on Strategic Marketing Management assignments, we've got those covered too! So get in touch with us today and get the best assignment help in Malaysia!

Recent Solved Questions

- MKT6205E: Marketing Management Case Study, IIU, Malaysia Nespresso was created in 1986 as a subsidiary of the Swiss group Nestlé. It was initially a supplier to the coffee

- Human Resources Management Assignment, SUT, Malaysia How can an employer determine whether the recruiting and selection procedures being used to select employees

- You are required to write a case study report with regards to issues pertaining to organizational development: Organizational Development and Change Management Case study, UIU, Malaysia

- Factors Influencing Perceived Stress and Its Impact Towards Food Consumption Behaviour During The Pandemic Assignment, MSU, Malaysia Coronaviruses are a group of viruses adapted from the family of Coronavidae that has caused a change in the lives

- Take the last available Z-score as a base, recommend possible actions that can be taken based: Financial Modelling Assignment, MUM, Malaysia

- BBUN2103 Contract Law and Commercial Disputes: Legal Principles and Case Analysis

- Data Organization and Information Management in Daily Life, Individual Assignment, Malaysia

- Information Technology Assignment, APU, Malaysia Octra Solutions is a privately owned, well-known software company located in Southern Malaysia

- English Essay, APU, Malaysia The occurrence of violence and abuse against children is on the rise. Discuss the causes and effects

- Procurement Management Assignment: Comparative Study of Methods for Large-Scale Projects