Fundamentals Of Finance II Assignment, MUM, Malaysia Anwar owns 500 shares of frozen food Awesome Food Berhad which he purchased during the recession in January

| University | Monash University Malaysia (MUM) |

| Subject | Fundamentals Of Finance II |

Question 1

Anwar owns 500 shares of frozen food Awesome Food Berhad which he purchased during the recession in January 2009 for RM25 per share. Awesome Food Berhad is regarded as a relatively safe company because it provides a basic product that consumers need in good and bad economic times. Anwar read in the Malaysian Business Journal that the company’s board of directors had voted to split the stock 2-for-1. In June 2015, just before the stock split, Awesome Food Berhad shares were trading for RM58.

Answer the following questions about the impact of the stock split on his holdings.

- How many shares of Awesome Food Berhad will Anwar own after the stock split?

- Immediately after the split, what do you expect the value of Awesome Food Berhad to be?

- Describe the total value of Anwar’s stock holdings before and after the split. What do you find?

- Does Anwar experience a gain or loss on the stock as a result of the 2-for -1 split?

- What are stock splits and the advantages of stock splits?

Question 2

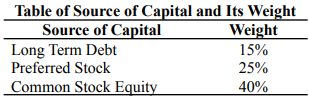

Nona Corporation is interested in measuring the cost of each specific type of capital as well as the weighted average cost of capital. Historically, the firm has raised capital in the following manner:

The tax rate of the firm is currently 40%. The needed financial information and data are as follows:

Debt

Nona can raise debt by selling RM1,000-par-value, 8.5% coupon interest rate, and 10-year bonds on which annual interest payments will be made. To sell the issue, an average discount of RM15 per bond needs to be given. There is an associated flotation cost of 2% of the par value.

Preferred stock

Preferred stock can be sold under the following terms: The security has a par value of RM100 per share, the annual dividend rate is 7% of the par value, and the flotation cost is expected to be RM5 per share. The preferred stock is expected to sell for RM101 before cost considerations.

Common stock

The current price of Nona’s common stock is RM28 per share. The cash dividend is expected to be RM2.80 per share next year. The firm’s dividends have grown at an annual rate of 5%, and it is expected that the dividend will continue at this rate for the foreseeable future. The flotation costs are expected to be approximately RM1.50 per share. Nona can sell new common stock under these terms.

Retained earnings

The firm expects to have available RM100,000 of retained earnings in the coming year. Once these retained earnings are exhausted, the firm will use new common stock as a form of common stock equity financing.

Demonstrate the calculation of the following:

- The after-tax cost of debt

- The cost of preferred stock

- The cost of retained earnings

- The cost of new common stock

- Demonstrate the firm’s weighted average cost of capital using retained earnings and the capital structure weights are shown in the table above.

- Demonstrate the firm’s weighted average cost of capital using new common stock and the capital structure weights shown in the table above.

Question 3

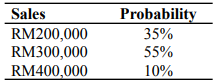

Sime Darby has made the forecast of sales shown in the following table. The probability of each level of sales is also given.

The firm has fixed operating costs of $68,000 and variable operating costs equal to 70% of the sales level. The company pays $10,000 in interest per period. The tax rate is 40%,

Answer the following questions

- What are the earnings before interest and taxes (EBIT) for each level of sales?

- What are the earnings per share (EPS) for each level of sales, the expected EPS, the standard deviation of the EPS, and the coefficient of variation of EPS, assuming that there are 10,000 shares of common stock outstanding?

- Sime Darby has the opportunity to reduce its leverage to zero and pay no interest. This change will require that the number of shares outstanding is increased to 14,000. Repeat part (b) under this assumption.

- Explain your findings in parts (b) and (c), and comment on the effect of the reduction of debt to zero on the firm’s financial risk.

Get Help By Expert

If you're struggling to write your thesis in Malaysia, look no further than Assignmenthelper.my! Our team of experienced writers and editors are here to provide you with the best thesis writing help to ensure that your work is of the highest quality and meets all of your academic requirements. Whether you need help with research, editing, or formatting, we're here to support you every step of the way. Contact us today to learn more about our Malaysian assignment help services and how we can help you achieve success in your academic journey.

Recent Solved Questions

- MIS7114: You Are Required To Source The Latest Article Regarding Issues In Technology And Operations Management: Technology And Operations Management, Assignment, UUM, Malaysia

- MPA21603: Managerial Economics Assignment, UTHM, Malaysia The demand and supply concepts are two of the basic concept in microeconomics. Select any decision-making

- Researchers compare the foreign policies of different countries to identify patterns, similarities, and differences: Foreign Policy and Diplomacy in Asia Pacific Research Paper, TU, Malaysia

- BMNG254: Diploma In Business Administration Assignment, LUC, Malaysia Identify the steps of the quantitative analysis approach and Describe three categories of business analytics?

- Positioning a brand effectively depends on aspects including the industry: Marketing Management, Essay, OUM, Malaysia

- Bachelor of Information Technology Data Analytics Assignment, HU, Malaysia Describe the data set in the Introduction in terms of where this data set came from, what the data is about, and what you plan to do analyze

- Choose a company you work for or any company of your liking or a specific product: Sustainability and Business, Assignment, MUM, Malaysia

- Propose and implement how you would embark data analysis journey for evidence-based: Advanced Data Analysis Assignment, TARC, Malaysia

- History Essay, UniKL, Malaysia Some of the most significant themes in the Elizabethan sonnet sequences include love, time, the value of writing

- Public relations Assignment, UTAR, Malaysia You need to find a news story in the media that discusses (explicitly or implicitly) the effects of public relations